Tlalnepantla de Baz, Estado de Mexico, October 25, 2017 - Mexichem, S.A.B. de C.V. (BMV: MEXCHEM*) (“the Company” or “Mexichem”) today announced its unaudited results for the third quarter of 2017. The figures have been prepared in accordance with International Financial Reporting Standards (“NIIF” or “IFRS”), having US dollars as the functional and reporting currency. All comparisons are made against the same period of the prior year. Unless specified to the contrary all figures are in millions. In some cases, percentages and numbers have been rounded.

Please note that the presentation of Mexichem’s 2016 third quarter results reflect the effects of several actions taken by the Company in 2016 and in the first quarter of 2017. A detailed review of these actions and their impact can be found on Page 16 of this release. It is highly recommended that you read these Clarifications prior to analyzing the Company´s 3Q17 results.

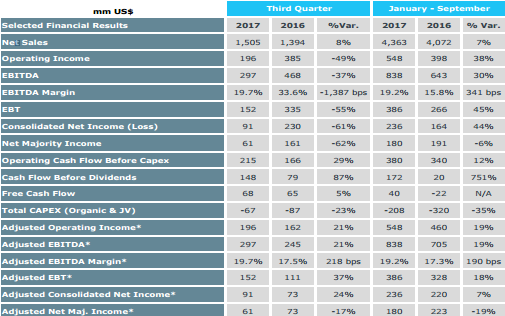

Third Quarter 2017 Financial and Operating Highlights (compared to 3Q16):

- Revenues increased 8% to $1.5 billion.

- EBITDA was $297 million a 21% increase compared to Adjusted EBITDA* of $245 million.

- EBT was $152 million up 37% from Adjusted EBT* of $111 million. • Consolidated Net Income increased 24% to $91 million vs Adjusted Consolidated Net Income and Net Majority Income totaled $61 million.

- Cash Flow before dividends was up 87% to $148 million and Free Cash Flow increased 5% to $68 million.

- TTM Adjusted ROE* was 8.0% and TTM Adjusted ROIC* was 7.3%, up 170 bps and 80 bps, respectively.

CONSOLIDATED SELECTED FINANCIAL RESULTS

*Given that Mexichem’s reported earnings results (including the impact of the asset write-off related to the accident at PMV’s VCM plant) differ substantially from its reported operating results (without the write-off), for clarification purposes, since the incident the Company´s quarterly reports have contained reported EBIT, EBITDA and net income including the one-time net effect related to PMV´s VCM plant, as well as*Adjusted EBIT, EBITDA and net income which exclude that effect. In the 1Q17 and 2Q17 the only effect recorded was business interruption insurance coverage, which is not considered to be a one-time effect. In the 3Q17 there was not recorded any business interruption insurance coverage, therefore the report for 3Q17 does not include a presentation of adjusted figures.

Nine Months 2017 Financial and Operating Highlights (compared to first Nine Months 2016)

- Revenues Increased 7% to $4.4 billion.

- EBITDA was $838 million a 19% increase compared to Adjusted EBITDA* of $705 million.

- EBT was $386 million, up 18% from Adjusted EBT* of $328 million.

- Consolidated Net Income increased 7% vs Adjusted Consolidated Net Income and Net Majority Income was $180 million.

- Cash Flow before dividends increased to $172 million from $20 million and Free Cash Flow increased to $40 million from a negative of $22 million.

Company Narrows EBITDA Guidance to High End of Range; Expects 2017 EBITDA to be 20%-25% Above 2016 Reported EBITDA of $884 million.